Atradius Trade Credit Insurance

Credit insurance protects your business from customers that fail to pay for your goods or services.

What we can do for your company?

Limit your risks

Do you deliver on account (credit) to other companies? Do you want to prevent your depreciation on debtors and protect your profit? Fill in the form and we will be happy to advise you on how to limit risks.

Receive free tailor-made advice

Our advisor will contact you by telephone as soon as possible and you will receive answers to your questions and information that suits your personal situation and specific needs during the interview.

Take out the right insurance

As a result of the consultation, you have the opportunity to take out credit insurance. Credit insurance protects your company against damage incurred by unpaid invoices.

We provide examples of high quality credit management processes and practices in a variety of different sectors and markets throughout the world. Read our case study of a leading company at automotive sector.

At a glance

-

Company

Rashi Peripherals

-

Trade Sector

Information Technology and Mobility

-

Market

Indian sub-continent

-

Challenge

To improve credit control processes with customers and negotiate better terms with banks.

-

Results

Rashi Peripherals is enjoying impressive growth with a compound annual growth rate of 25%.

-

How we made it happen

By providing credit management services and debt collections services, we support Rashi Peripherals' own in-house credit controls and enable them to grow their market with confidence.

Case Study

Rashi Peripherals is one of India’s leading IT distributors with a track record spanning nearly 30 years. Navin Agarwal, Head of Accounts and Finance at Rashi Peripherals describes our work as an integral part of their own credit control processes.

We began working with Rashi Peripherals in 2014. The primary business aim of Rashi Peripherals is to maintain business growth and expand the reach of the 51 branch offices and service centres throughout India. Working with Atradius and its insurance partner in India provides an important aspect of the company’s wider growth plans.

The company enjoys impressive success across the nation. In addition to a compound annual growth rate of 25%, Rashi Peripherals has won many distributor awards from companies such as Logitech, Intel, Lenovo and many more. Navin Agarwal explains their success is thanks in part to their strong financial systems underscored by rigorous and transparent credit controls.

He says: “Atradius and its insurance partner in India effectively helps us to evaluate our customers twice. We are very proactive and make sure we conduct due diligence on all of our customers.”

Atradius and its insurance partner in India also do this as part of the process for agreeing credit limits. “In addition to being a core requirement of our business processes as directed by our Board, the credit insurance supports our financial controls and helps us minimise the risk of debtors and helps our company to grow and stay healthy. We are a successful business with good credit control.”

Credit insurance provides information and security to help us move into new markets.

Navin Agarwal - Head of Accounts and Finance, Rashi Peripherals

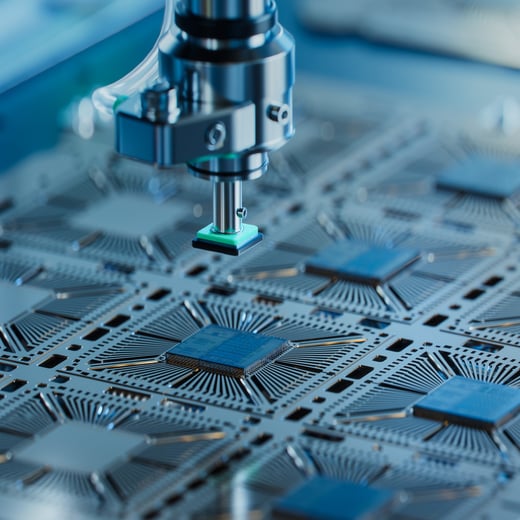

At a glance

Company

Giti Tire Pte Ltd

Trade sector

Automotive

Market

Global

Challenge

To provide a credit insurance service that forms an integral part of the company’s risk management and sales processes across the world.

Results

Worldwide support and advice that is able to grow with the company.

How we made it happen

With a proactive team located close to Giti Tire Pte Ltd in Singapore with joined up support in each major customer location.

AimsAs one of the world’s leading manufacturers, Giti Tire Pte Ltd, uses credit insurance as an integral part of the company’s accounts receivable risk management and sales processes. Victor Goh, Treasury Manager, explains: |

|

|

“It is our aim to make sure that customers with material accounts receivable exposures will be covered by credit insurance and our sales limits are set based on the approved limits that we agree with Atradius. If credit sales exceed approved credit insurance limits, additional collaterals in the form of bank guarantees or some cash advance payments will be requested from our customers.”

He adds: “Other than credit risk management, we also leverage on the credit ratings provided by credit insurer on individual buyers to alert our sales team on potential deterioration of buyer’s financial health. |

We also appreciate the country and industry segment insights provided by our credit insurance partner.” |

We chose Atradius because it is a leading player in the global credit insurance market space and offers competitive premium pricing

Victor Goh - Treasury Manager, Giti Tire Pte Ltd

Do not run any risk and opt for certainty

Atradius Credit Insurance helps you mitigate credit risk with a process that follows a simple step-by-step approach. No matter the size of your trade deal, whether you are trading with an existing customer or a prospect, and whether you are selling domestically or internationally, our process always follows these simple steps.